Polestar may be based in Sweden and Chinese owned, but when it comes to running the business, Britain is now the brand’s global blueprint.

Speaking to Electrifying.com at the announcement of its biggest model push yet, Polestar CEO Michael Lohscheller said: “The UK is our role model. When I travel to Germany I say, we need to learn from the Brits.”

Polestar’s numbers in the UK explain why, the company nearly doubling its sales in 2025, reporting a 95% year on year increase to 17,000 cars.

The UK is now Polestar’s largest market outside Sweden, outselling even the USA and accounting for 29% of global sales. Nearly one in three Polestars sold worldwide is now bought in Britain.

Globally, Polestar grew retail sales by 34% in 2025, although it is forecasting more cautious low double-digit growth this year as it focuses on profitability and discipline. And the way the UK market is growing has reshaped strategy.

“We have gone away from showing to active selling,” said Lohscheller. “Visit your local dealer, you trust him or her, you test drive the car, you come back next weekend, and then you purchase. This is key to success.”

The UK currently has around 15 Polestar retail sites, with plans for a modest increase to around 18 to 20. “A limited number but really high performing ones is the recipe for success. We won’t go to 60,” added Lohscheller.

Crucially, many of the current sites are operated in partnership with established Volvo retailers, giving Polestar access to an experienced sales and service infrastructure from day one. It’s a structural advantage that many newer EV entrants simply don’t have.

Returning to physical retail is only half the story to help build sales. Lohscheller admitted that until now, Polestar has been operating in a relatively narrow slice of the electric car market, but plans to expand that. “As of today, we are capturing around 25% of the BEV segments,” he said.

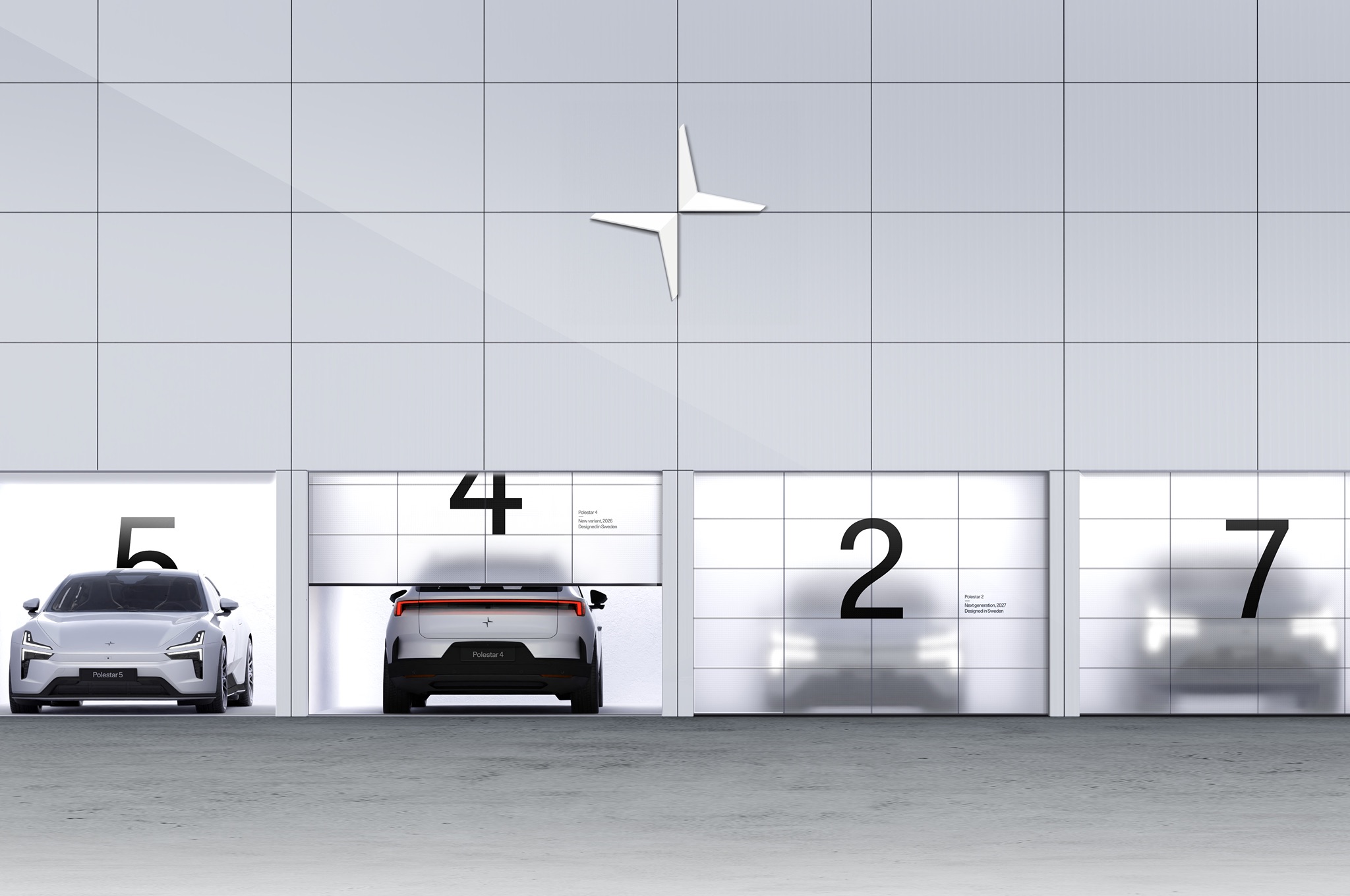

Polestar’s current line-up – led by Polestars 2, 3 and 4 – sits in specific premium niches, and Lohscheller acknowledged that the brand now needs to broaden its reach. So by 2028, the company plans to launch four new cars.

“With the new cars, we go to 55-60% of the market,” he said, adding that he believes broader segment coverage will be key to pushing the brand beyond 100,000 annual sales.

First to arrive will be the Polestar 5 in summer 2026, and the car Polestar wants to be judged by. Built on a lightweight bonded aluminium platform, it’s a proper four-door GT - low, sleek and unapologetically premium. Lohscheller calls it the brand’s “halo car”, and admitted to me he can’t wait to get one as his company car.

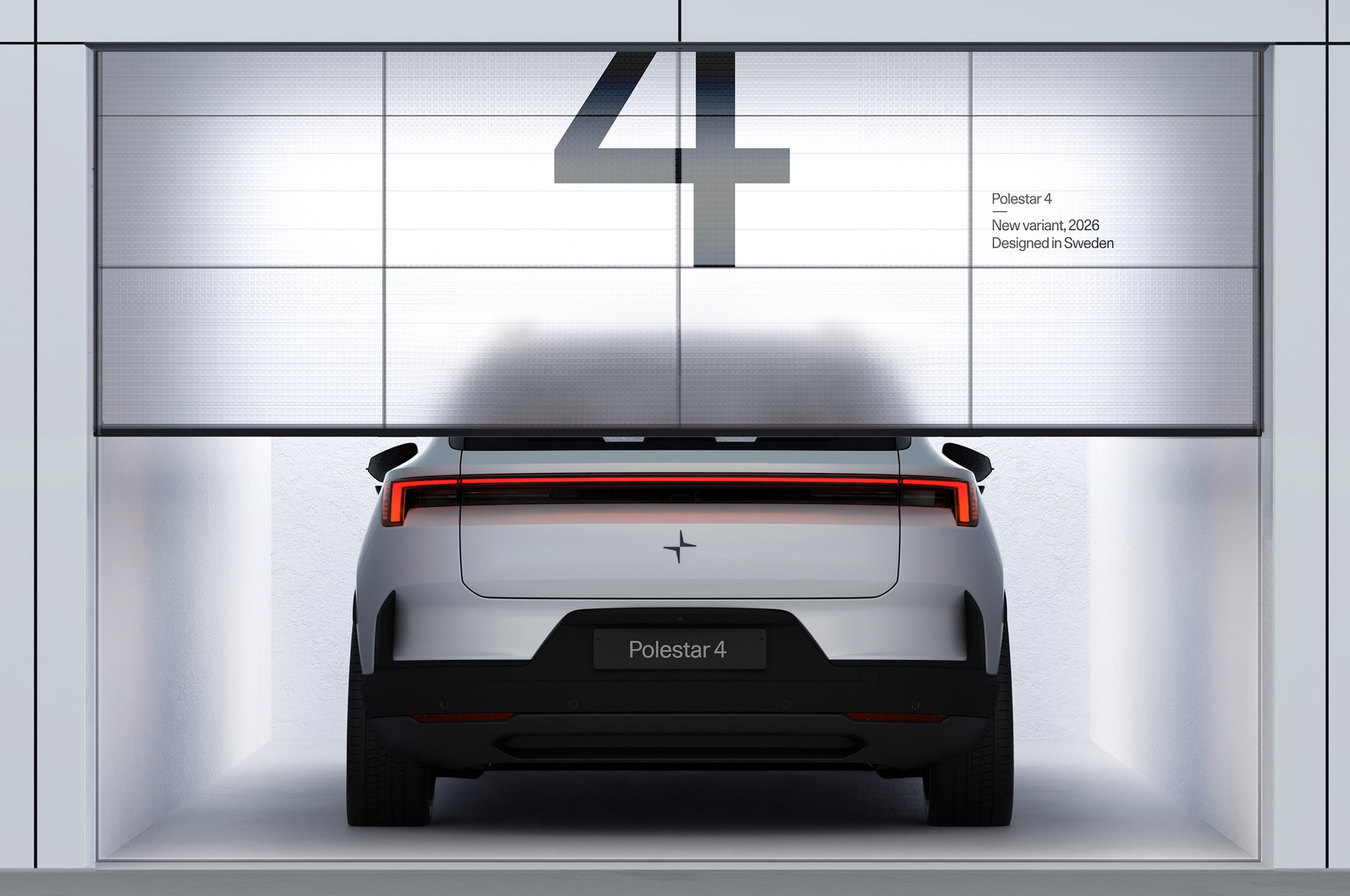

The Polestar 4 is already the brand’s bestseller, but later this year a new – more practical – variant will broaden its appeal and crucially, it brings back something many buyers missed: a rear window.

Lohscheller told me it was one of the first decisions he made when he joined the company. “When I looked at the Polestar 4, I said we need a more practical version of this,” he explained. “Some people have dogs.” As a dog owner myself – I approve.

The new version gets a more practical tailgate and a bigger load area, and while Lochscheller told me the brand is undecided whether to call it an SUV, estate or wagon, my vote is firmly wagon – it feels cooler, and very on-brand.

The existing car will stay too, but will be renamed the Polestar 4 Coupé, although Polestar expects the ‘wagon’ to become the big seller.

Polestar’s next-generation 2 (though we still love the current one) arrives in early 2027, and this isn’t a facelift – it’s a completely new car. Lohscheller says the replacement is coming “in record speed”, which feels less like a boast and more like a necessity in such a fiercely competitive and fast moving segment.

Then comes the Polestar 7 in 2028 – a compact premium SUV built in Europe, and arguably the most strategically important launch of the lot. Compact SUVs made up around a third of all BEV volumes in Europe in 2025, and this is where Polestar has its biggest chance to scale beyond niche premium territory.

Polestar may also be benefitting from buyers turning away from Tesla. In a 2025 Electrifying.com survey, two-thirds of respondents said they were put off buying a Tesla because of Elon Musk himself. But Lohscheller rejects the idea that the UK surge is simply a backlash effect. He points instead to that deliberate shift in retail strategy – what he calls the “Renaissance of the dealers”.

Polestar also says its average customer is 45 years old – roughly a decade younger than the traditional premium car buyer – which may also explain why Polestar is holding firm on its EV-only stance while some competitors soften their electrification timelines.

Despite being owned by Chinese automotive giant Geely, Lohscheller signalled a clear strategic pivot. “Europe is absolutely the focus,” he said. He described China as “hyper-competitive” and “not a top priority at the moment” – a notable recalibration for the brand.

The US remains important, but regulatory uncertainty makes it harder to predict. Instead, Polestar is doubling down on becoming a premium European BEV-only brand, building scale where it already has traction.

And right now, that traction is strongest in Britain – and Polestar is using the UK as proof that its European EV-only strategy can scale.